Sony’s image sensor business is a behemoth. Back in January 2016, I told you that Sony would use its sensor production to rule the digital imaging world. Now, it’s getting so big that one of Sony’s large investors wants to see its image sensor business spun off into a separate entity.

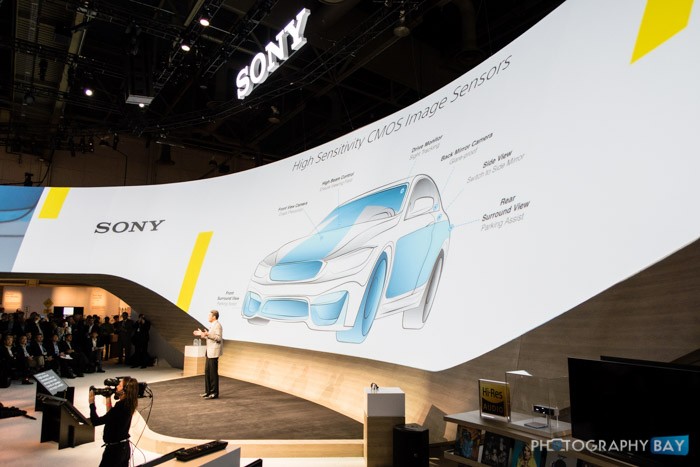

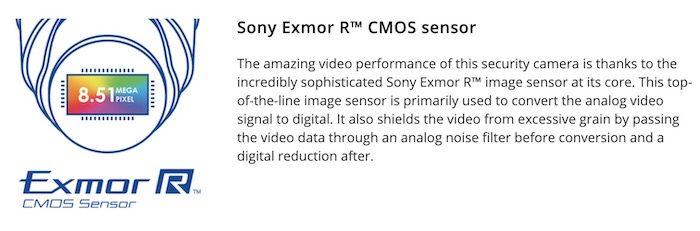

Sony’s superior image sensor design is seen in auto manufacturers’ backup cameras, consumer and industrial security cameras and, of course, a litany of consumer and professional digital cameras. From Sony pocket cams to incredible low-light security imagery with Exmore R sensors in Lorex POE network cameras, Sony’s imaging sensor is unparalleled in design and performance.

Sony Sensor Highlight via Lorex Security Cam Product Page

According to Reuters, “It is now the world’s top maker of image sensor chips, used mostly in smartphone cameras. In the year ended in March, the unit accounted for 16% of Sony’s total operating profit of roughly $8 billion.”

Investor Daniel Loeb’s fund, which “has invested $1.5 billion in Sony, is calling for Yoshida to spin off chips into a standalone company. The rebranded Sony Technologies could be worth $35 billion within five years, the activist argues.”

Whether Sony moves on Loeb’s push spin-off chip manufacturing to a new Sony Technologies entity requires consideration of slowing smartphone sales and an evolving trade war with China. While there may be some short-term hiccups, Sony seems well-positioned to continue the offensive in the digital imaging world.

Whether you have a Sony-branded camera around your neck, it is more likely than not that you have a Sony image sensor in one or more products that you own. And that will remain true whether or not Sony’s image sensor production spins out to a standalone Sony Technologies company.